Unlock Your Future: $10,000 Assistance Program for First-Time Homebuyers

Take a step closer to your new home with our $10,000 Down Payment Assistance Program! This program is designed to help eligible buyers overcome financial barriers to homeownership by providing funds to cover down payment and closing costs.

Key Features

- Program Follows FHA and VA Guidelines

- Interest Rates pre-set by the State of Florida (as of 12/15/24)

- FHA & VA: 6.75% (No Points)

- Minimum Credit Score: 640.

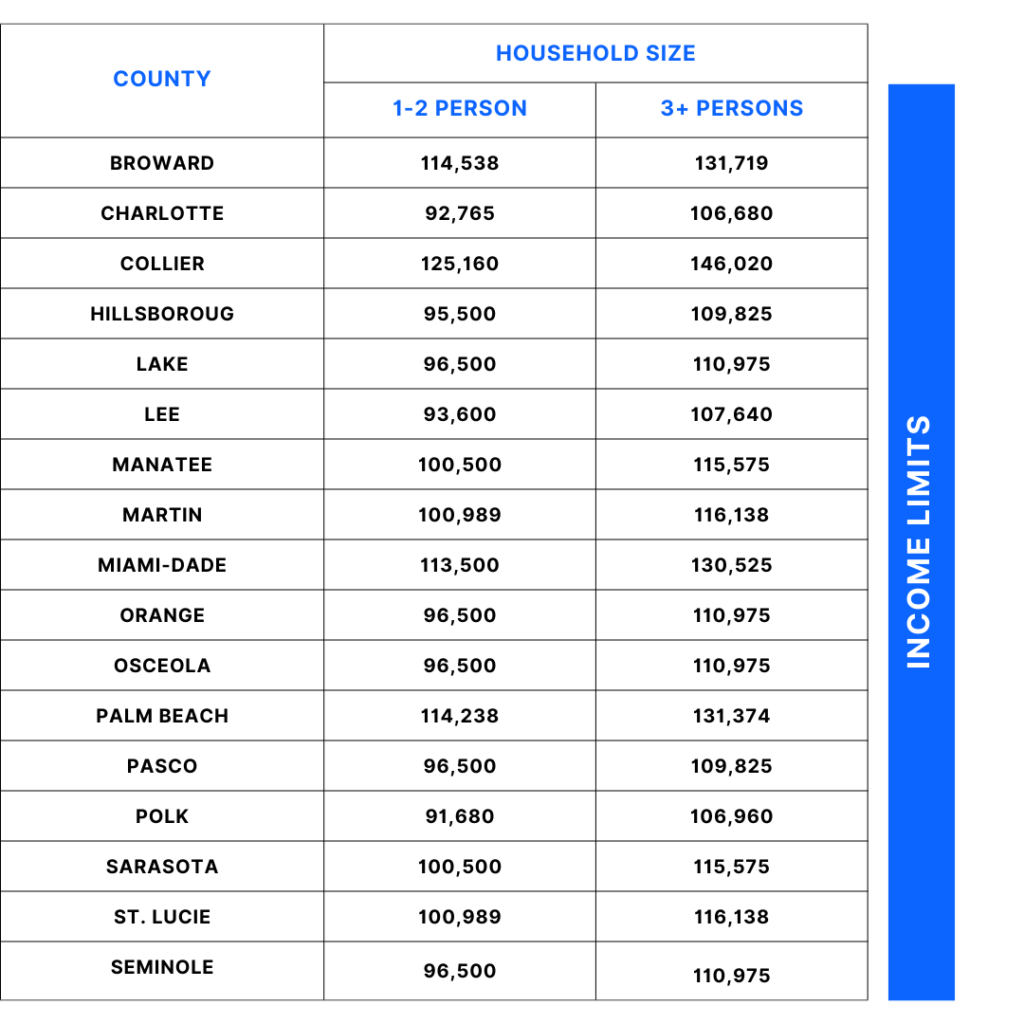

- Income Cap: (Refer to the chart for details)

- For primary residence only

- Income only qualification

- 1-4 units

- Any property location in the state of Florida applies

- We aim to close these loans in 25 days!

Eduardo Saenz, Branch Manager

Lower.com – Florida Branch

📧 esaenz@lower.com

Our Branch Manager

Exciting news from Lower.com – Florida Branch! We’re offering a $10,000 assistance program for first-time homebuyers to help with down payments, closing costs, or other expenses.

Here’s why this is a great opportunity:

✔ $10,000 in assistance for eligible buyers.

✔ Expert guidance every step of the way.

✔ Flexible options to simplify your homebuying journey.

Don’t miss out—contact us today!

FAQs

What’s the minimum credit score?

The minimum credit score is 640. If needed, we can assist clients with improving their credit score at no cost to them.

Is there an income limit?

Yes, but it’s one of the highest among DPA programs in Florida.

What are the program guidelines?

The program follows FHA or VA guidelines, as applicable.

How quickly can you close these loans?

We can close these loans in around 25 days!

What is the interest rate for this program?

The interest rate for this program is preset by the State of Florida and is currently 6.75% for FHA and VA loans (as of 12/15/24).

Are there enough funds for this program?

This program has consistently maintained funding since its inception.

Does this program apply to other states?

This program is available to clients employed by a Florida-based company.

What kind of property is eligible for this program?

Any residential property (1–4 units) located in the state of Florida is eligible.

Do you need to be a first-time homebuyer?

Yes, it applies to clients who haven’t owned a property in the past three years.

Does the household income cap apply to all individuals living in the house?

Yes, regardless of whether they are on the loan or not, the income of all household members is considered when calculating the income cap.

© 2024 All Rights Reserved.